10 Singapore fintech startups that you should know

Fatacash

Year founded: 2012

Business model: Fintech – Money Transfer

Official Website: https://www.fastacash.com/

Total Equity Funding: $23.5M in 4 Rounds from 7 Investors

Most recent funding: $15M Series B on July 14, 2015

fastacash provides a global social payments platform which allows users to transfer value (money, airtime, other tokens of value, etc.) along with digital content (photos, videos, audio, messages, etc.) through social networks and messaging platforms. The company has developed a patent pending link generation technology that enables the value transfer with a secure link.

Get to know more at:

https://www.techinasia.com/fastacash-series-b-funding

https://techcrunch.com/2015/07/14/fastacash/

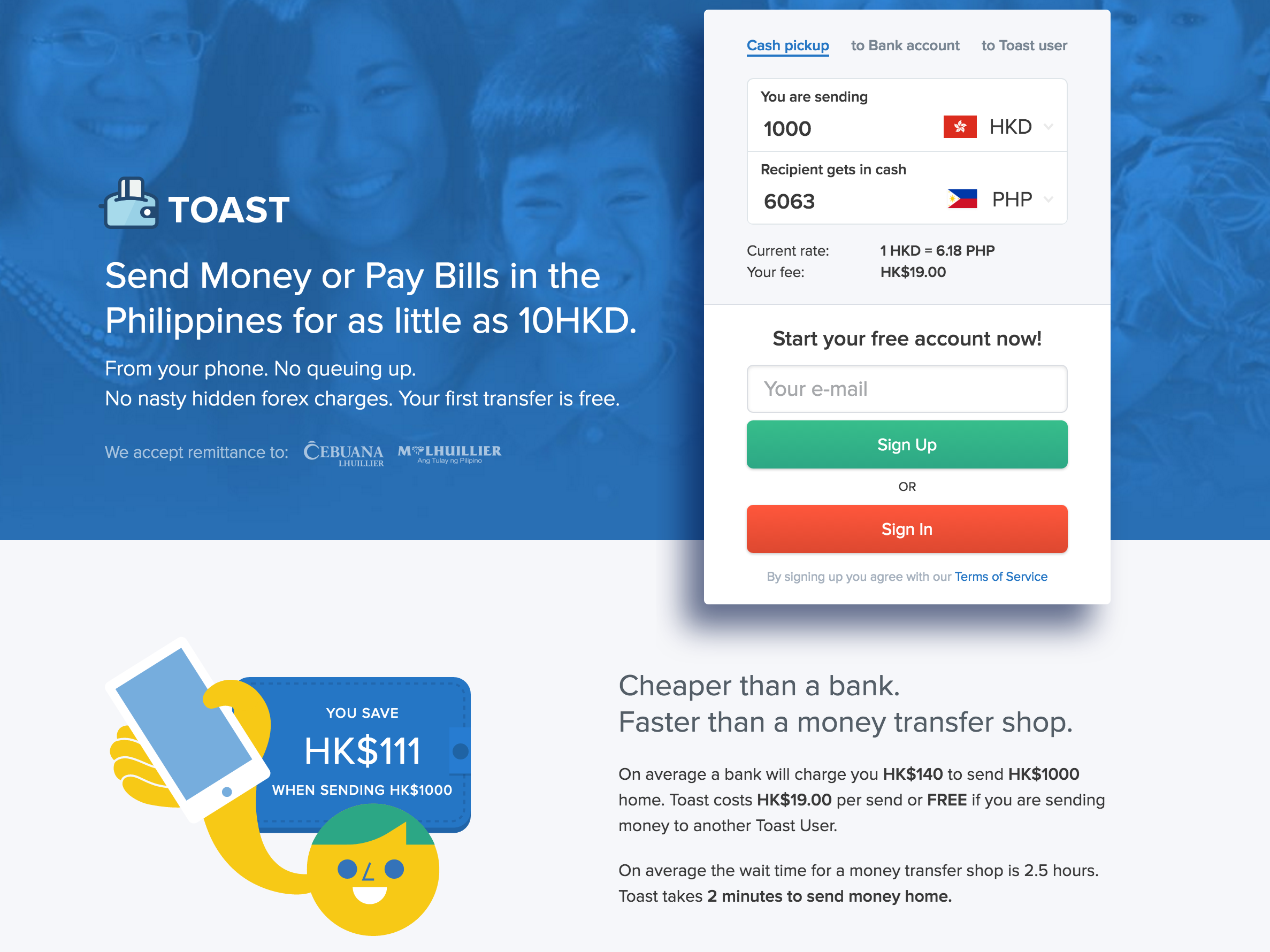

TOAST ME

Year founded: 2015

Business model: Fintech – Money Transfer

Official Website: https://toastme.com/

Total Equity Funding: $865.93k in 2 Rounds from 4 Investors

Most Recent Funding: $850k Seed on October 9, 2015

TOAST is a Peer 2 Peer money transfer application that allows Filipinos in Singapore, Hong Kong to remit money back home directly from a smartphone without the need to utilize existing banking infrastructure or queue up at a Money Transfer Shop. They make themselves unique in terms of the most efficient price offerings.

Get to know more at:

https://e27.co/singapores-fin-tech-startup-toast-raising-us750k-seed-20150708/

https://www.techinasia.com/toast-profile-seed-funding

Kyepot

Founded: 2015

Business model: FinTech – Lending

Official Website: http://www.kyepot.com/

Total Equity Funding: $215.93k in 3 Rounds from 2 Investors

Most Recent Funding: $175k Seed on February 28, 2016

Kyepot brings social financial service to the digital age. People with bank accounts find it difficult to save and people without bank accounts incredibly harder. Financial exclusion limits access to good product for saving and borrowings. They offer tools for people to save in trusted communities. The borrowing is at a reduced cost of capital so a win win for everyone.

Get to know more at:

M-DAQ

Founded: 2010

Business model: FinTech – Online Wealth Management

Official Website: http://www.m-daq.com/

Total Equity Funding: $11.7M in 1 Round from 2 Investors

Most Recent Funding: $11.7M Series B on October 21, 2013

Founded by a group of veterans from the FX and Securities Industries with experience averaging 15 years amongst the key members, M-DAQ is a game-changing platform that prices and trades exchange-traded products in a multitude of choice currencies by blending ‘executable’ FX rates into equities and futures products. M-DAQ enables Securities Exchanges to go multi-currency without significant changes to systems and back-end processes, with low start-up and running costs. All investors now, regardless of profile or trade size, can benefit from a multi-bank FX wholesale price in their overseas investment. It is a Game Changer that aims to create a World without Currency Borders.

Get to know more at:

https://www.techinasia.com/alibaba-alipay-m-daq

https://themerkle.com/alibaba-continues-expansion-plan-through-m-daq-investment/

http://ecommerceiq.asia/alipay-invested-in-singaporean-startup-m-daq/

Mesitis

Founded: 2013

Business model: FinTech – Online Wealth Management

Official Website: https://mesitis.com/

Total Equity Funding: $6.13M in 3 Rounds from 1 Investor

Most Recent Funding: $2.35M Venture on May 16, 2016

Mesitis empowers individual investors and their advisors with account aggregation and visualization across asset classes and banks. They run 3 different business lines, all of which are chosen because of large revenue potential with almost no direct competition; including: Canopy – Data Visualization, Canopy – APIs from PDF statements, Mesitis Securities – Discount Broker to the High Networth

Get to know more at:

https://e27.co/started-mesitis-world-needs-20150107/

https://www.techinasia.com/mesitis-canopy-series-a-funding

OTDocs

Founded: 2015

Business model: Fintech – Blockchain

Official website: http://otdocs.com/

Open Trade Docs reduces errors, bottlenecks and fraud risks in trade finance by creating digital, non-repudiable, original documents, and complementing paper originals with unique digital copies. Both digital-paper and paper-digital pairs have full lifecycle and audit trail. By using private blockchains, participants remain in control of all data and access rights instead of relying on a third party. Auditable OTDocs uses blockchain technology to ensure that once written, data can not be amended, even by system administrators.

Get to know more at:

https://www.techinasia.com/mesitis-canopy-series-a-funding

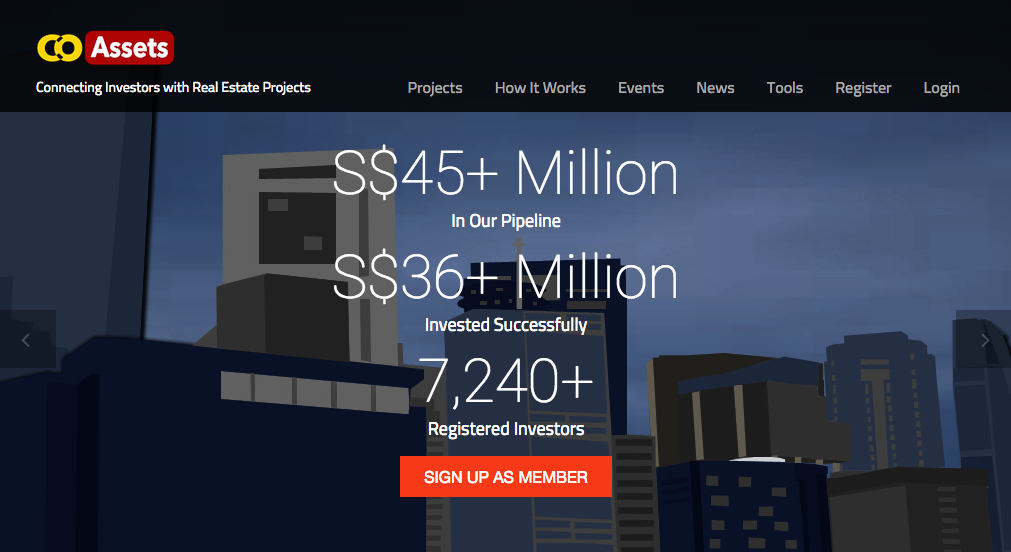

CoAssets

Founded: 2013

Business model: FinTech – Crowdfunding/Investment

Official website: http://www.coassets.com/

Total Equity Funding: $736.83k in 1 Round

Most Recent Funding: $736.83k Series A on February 12, 2015

CoAssets is Asia’s first listed crowdfunding platform. This platform connects those with exclusive investment opportunities to keen investors.

CoAssets is a real estate opportunity and crowdseeking platform that makes it easy for aspiring real estate developers and fundraisers to connect with investors on exclusive and undervalued investment opportunities. CoAssets enables them to engaged investors across national/regional boundaries and maximizes their exposures to alternative sources of funds.

Get to know more at:

https://www.crowdfundinsider.com/2016/05/86294-coassets-expands-opens-second-singapore-office/

TradeHero

Founded: 2012

Business model: FinTech – Finance Management/Comparision

Official website: http://en.tradehero.mobi/

Total Equity Funding: $10.46M in 2 Rounds from 4 Investors

Most Recent Funding: $10M Series A on September 26, 2013

Founded in 2012 by app developer MyHero, TradeHero’s mission is to provide a platform for traders to monetize their investment expertise, by democratizing trading in a social and gamified mobile app. TradeHero is a free stock market simulation app, which draws real-world data from stock exchanges to create an un-rivalled global social investment network. Users can compete with friends from their social networks, or on the global leaderboards with users from across the world. The app brings novice and knowledgeable traders together, allowing novice traders to subscribe for stock tips via push notifications, and top traders to earn subscription fees from followers.

Get to know more at:

https://www.techinasia.com/tradehero-just-pure-epic

https://www.techinasia.com/tech-in-asia-singapore-2015-tradehero

Call Levels

Founded: 2014

Business model: FinTech – Data Management

Official website: https://www.call-levels.com/

Total Equity Funding: $500k in 2 Rounds from 6 Investors

Most Recent Funding: Seed on January 10, 2016 / Undisclosed Amount

Call Levels is a simple, independent and reliable tool to track users’ financial assets. The automatic notification feature frees users from the time-consuming market analysis tasks.

Get to know more at:

https://www.techinasia.com/singaporean-fintech-startup-call-levels-investment-by-lippo-group

FitSense

![]()

Founded: 2015

Business model: FinTech – InsurTech

Official website: http://www.getfitsense.com/

Total Equity Funding: $16.29k in 1 Round from 2 Investors

Most Recent Funding: $16.29k Seed on December 8, 2015

The most effective, convenient, and reliable way to save on any insurance premium.

Fitsense is a data analytics platform working with insurance companies to reduce insurance premiums for anyone with a smartphone or wearable.

Fitsense is developing a data analytics platform to help health & life insurance companies personalize insurance by using wearable data.

Get to know more at: